Real Estate Law Changes. Expert Opinions to Provide a Comprehensive Guide on Real Estate Market Trends

As a seasoned real estate professional with several years of experience navigating the ever-evolving landscape of property transactions, I’ve witnessed firsthand how legislative shifts can significantly impact our industry. The upcoming changes in real estate laws for 2024 promise to reshape various aspects of how we conduct business, from lead generation and real estate licensing to property tax regulations and affordable housing. Let’s delve into the key real estate law changes and their potential impacts.

Real Estate Law Changes: Increased Regulation of Short-Term Rentals

Short-term rental platforms like Airbnb and Vrbo have transformed the way we think about vacation lodging and investment properties. With their rise, many cities and states have recognized the need for stricter regulations to address housing shortages, neighborhood disruptions, and tax compliance issues.

Stricter Licensing Requirements: Property owners are now required to obtain specific licenses or permits to operate short-term rentals in many jurisdictions.

Limitations on Rental Duration: Many cities are imposing limits on the number of days a property can be rented out annually as a short-term rental.

Zoning Laws: New zoning restrictions aim to limit short-term rentals in residential areas.

These regulations are intended to balance the benefits of short-term rentals with the need to protect housing availability and community integrity. Property owners who rely on short-term rental income will need to ensure compliance with these new local laws, which could involve additional costs or reduced rental availability.

Real Estate law changes: Affordable Housing Initiatives

Affordable housing remains a pressing issue across the United States. In response, federal, state, and local governments are introducing measures to increase the availability of affordable housing.

Incentives for Developers: Expansion of tax credits and subsidies to encourage the development of affordable housing units.

Inclusionary Zoning: More cities are requiring a percentage of new residential developments to be affordable for low- and moderate-income households.

Rent Control and Tenant Protections: Strengthened rent control laws and enhanced tenant protections to prevent displacement and ensure housing stability.

These initiatives are designed to address the housing affordability crisis, making it easier for low- and middle-income families to find and maintain housing. Developers may find increased opportunities and incentives to participate in affordable housing projects. Landlords will need to navigate stricter rent control regulations.

Real Estate law changes: Environmental and Energy Efficiency Standards

Sustainability and energy efficiency are increasingly important in real estate. New regulations aim to promote greener building practices and improve energy efficiency in both residential and commercial properties.

Updated Building Codes: Higher energy efficiency standards for new constructions.

Retrofit Requirements: Existing buildings may need to undergo energy efficiency retrofits. Particularly in states with ambitious climate goals.

Green Certifications: Incentives for obtaining green building certifications. Such as LEED (Leadership in Energy and Environmental Design).

While these regulations may increase construction and renovation costs in the short term, they promise long-term savings through reduced energy costs and higher property values. Real estate professionals must stay informed about these standards to guide their clients effectively and capitalize on available incentives.

Real Estate law changes: Changes in Property Tax Laws

Property tax laws are frequently adjusted to meet budgetary needs at the state and local levels. The changes for 2024 reflect efforts to ensure equitable tax burdens and generate necessary revenue for public services.

Reassessment Cycles: Shortened reassessment cycles, leading to more frequent updates in property valuations and tax obligations.

Tax Exemptions and Relief Programs: New or expanded tax relief programs to support homeowners, particularly seniors and low-income families.

Commercial Property Tax Adjustments: Changes in how commercial properties are assessed and taxed, potentially leading to higher taxes for commercial real estate owners.

More frequent reassessments may lead to higher property taxes for homeowners and commercial property owners, especially in rapidly appreciating markets. However, expanded relief programs may offer some financial relief. Real estate professionals should advise clients on navigating these changes and exploring available tax relief options.

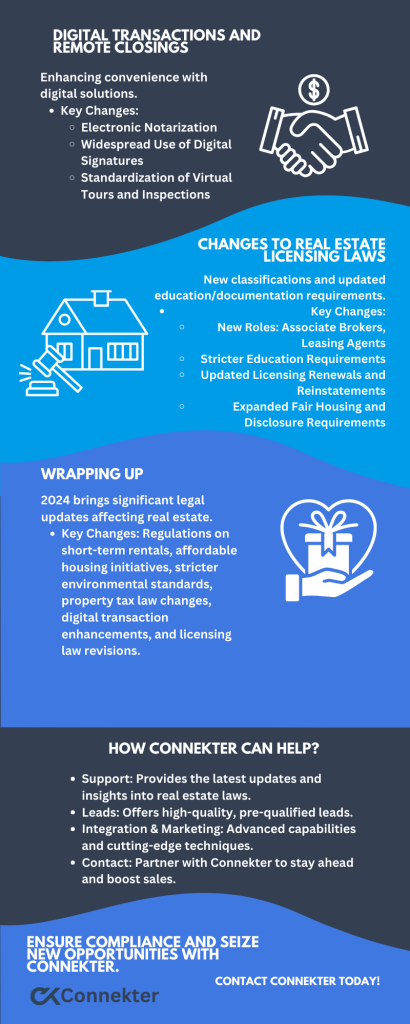

Real Estate law changes: Digital Transactions and Remote Closings

The COVID-19 pandemic accelerated the adoption of digital solutions in real estate, including electronic signatures and remote closings. Many states have now permanently adopted these practices.

Electronic Notarization: More states are allowing electronic notarization, facilitating remote closings.

Digital Signatures: The use of digital signatures for real estate documents is now widely accepted.

Virtual Tours and Inspections: Virtual tours and inspections are becoming standard practice, supported by new regulations ensuring their validity.

These changes enhance the convenience and efficiency of real estate transactions, making it easier for buyers and sellers to complete deals remotely. Real estate professionals must stay updated on the latest digital tools and legal requirements to provide seamless service to their clients.

Real Estate law changes Licensing Laws

On April 1, 2024, many provisions of Public Act 23-84, which revised real estate licensing and enforcement statutes, will become effective. These changes introduce new classifications of real estate professionals and update requirements for education and documentation.

Associate Brokers: A new classification allowing brokers to work under a supervising broker.

Leasing Agents: Designation for individuals employed by large rental complexes to perform certain leasing activities without a real estate license.

Education Requirements: Stricter requirements for real estate schools, including registration, course approval, and instructor qualifications.

Licensing Renewals and Reinstatements: Licenses will now expire every two years, with updated fees and streamlined processes for renewal and reinstatement.

Fair Housing and Disclosure Requirements: Expanded fair housing disclosures and new rules for retaining documents electronically.

These changes are designed to enhance professionalism and accountability in the real estate industry. Real estate professionals need to ensure compliance with new licensing requirements and take advantage of updated educational opportunities to stay competitive.

Real Estate law changes: Wrapping Up

The real estate market in the USA is facing several key legal updates in 2024, including increased regulations on short-term rentals, affordable housing initiatives, stricter environmental standards, changes in property tax laws, and the rise of digital transactions. Significant changes to real estate licensing laws will affect how professionals operate. Staying informed and adapting to these changes is essential for real estate professionals to navigate the evolving market and continue providing high-quality service to their clients.

Real Estate Law Changes: Which Real Estate Investment Is Best?

Navigating these changes can be daunting. With Connekter, you’re never alone.Our platform keeps you informed with the latest updates and insights into real estate laws, ensuring you stay ahead of the curve.. We offer high-quality, pre-qualified leads that save you time and increase your conversion rates.

With advanced integration capabilities, cutting-edge marketing techniques, and a proven track record of success, Connekter equips you with the tools you need to thrive in any market condition.

Are you ready to adapt to the new real estate landscape and boost your sales? Contact Connekter today to discover how our exclusive leads and innovative solutions can transform your business. Don’t let these changes catch you off guard—partner with Connekter and stay ahead of the game.

By staying informed and leveraging the right tools and resources, you can navigate the upcoming changes in real estate laws with confidence. Let Connekter be your trusted partner in this journey, ensuring you continue to thrive and succeed in the dynamic real estate market.

I do not even know how I ended up here, but I thought this post was great.

I don’t know who you are but certainly you’re going to a famous blogger if you aren’t already ;

) Cheers!

This site certainly has all of the information and facts

I needed about this subject and didn’t know who to ask.