Real estate. About property taxes and how it can influence your business. How it affects Homeowners and Investors?.

Do you know the new real estate tax laws? Have you thought about how they influence your business?

These changes have an impact. Whether you are an owner or a buyer. In the midst of this panorama, how to stay afloat? How to make your business prosper with fewer difficulties?

It’s not too complicated. But it is important to be aware of these changes. And keep growing!

A lead generation platform can be a good ally in real estate. It will keep you updated. And you will get clients at the same time.

If you are interested in exploring these options, continue reading. I tell you about these changes and how to grow your real estate business.

What changes in real estate property taxes mean for home buyers

The 2024 budget introduced significant changes in real estate. This, in the taxation of capital gains in different asset classes. Had notable adjustments to property taxes. The government has reduced the tax rate on long-term capital gains. From 20% to 12.5%.

But that is not all. Because?

Although the tax rate was reduced, the government eliminated the indexation benefit. What is indexing? Indexing adjusts the purchase price of an asset to inflation, thereby reducing profits and ultimately tax liability.

Furthermore, the Finance Minister clarified that property values indexed up to 2001 are protected. This is for capital gains purposes. It means that the removal of indexation benefits will not apply to properties owned before 2001. They will continue to enjoy these benefits to the real estate market.

For properties purchased after 2001, the actual acquisition cost will be considered. Short-term capital gains will continue to be taxed at the fixed rate. These changes will take effect from July 23, 2024.

So is this beneficial for home buyers and sellers?

This measure will not affect those who sell a house and reinvest in a new one. Because they can offset past capital gains from the sale of the old house. This, with the purchase of a new house within two years. According to Section 54 of Income Tax. Act.

But what about those who invest in assets other than property or don’t reinvest the money at all?

A CLSA analysis indicates that the change will affect investments in the relatively short term. In these, the market price growth is less than 10%.

However, when property price appreciation exceeds 10% annually, the impact of this new regime would be neutral or marginally beneficial.

Real estate. How to get potential clients in this context?

The important thing is not to let your business or income stop. Regardless of these changes. If you are looking for a way to save time and resources, Connekter is an option. You will be able to explore various tools.

The most interesting thing is that you can manage all your data from one place. Its segmentation work will help you prioritize actions.

Through a classification of data according to various criteria. This way, at Connekter, your clients will be classified. These criteria include: area, location or the degree of interest they have.

At Connekter, information is collected in different ways. Through forms or questionnaires. This allows creating alliances with other platforms. So it will increase your reach and, therefore, potential customers. In addition, with our associated blog, you can stay up to date with all the news.

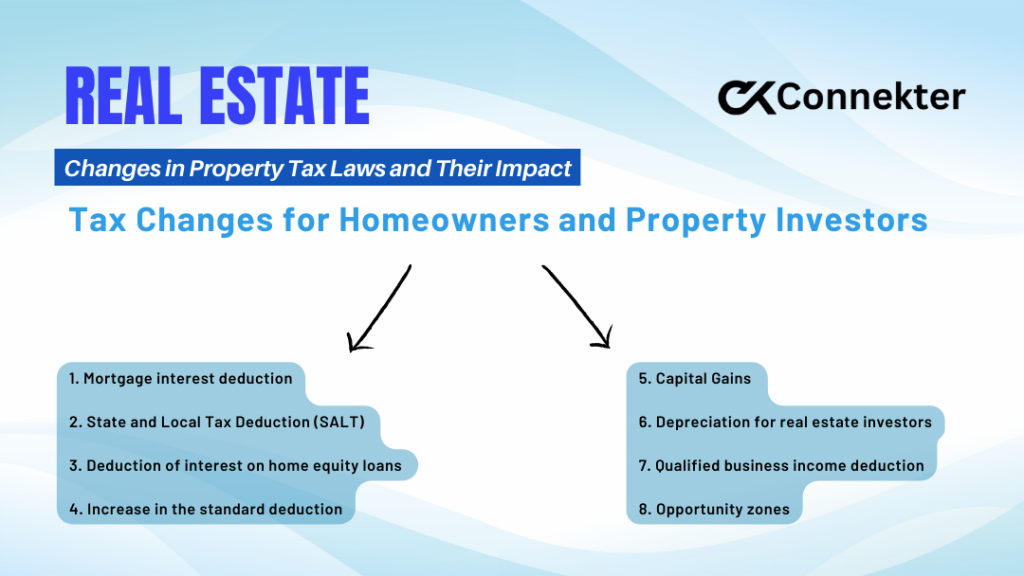

Real estate: Tax Changes for Homeowners and Property Investors

Staying informed about these modifications is crucial for effective financial planning. And thus, optimize profitability.

1. Mortgage interest deduction

One of the most significant changes in recent years. The Tax Cuts and Jobs Act (TCJA) of 2017 limited the mortgage interest deduction. This is for new loans. Up to $750,000, down from the previous limit of $1 million.

This change affects homeowners who took out mortgages after December 15, 2017. Existing loans up to the previous limit are grandfathered in. It means homeowners with older mortgages can still deduct interest on loans up to $1 million.

2. State and Local Tax Deduction (SALT)

The TCJA has also limited the SALT deduction. Allows homeowners to deduct state and local property taxes. As well as state and local income taxes or sales taxes. The new limit is set at $10,000.

3. Deduction of interest on home equity loans

This change emphasizes the importance of keeping track of how loan funds are spent. With mortgage guarantee. To ensure they qualify for the interest deduction.

4. Increase in the standard deduction

The TCJA nearly doubled the standard deduction. This makes it less advantageous for many homeowners to itemize deductions.

5. Capital Gains

Exclusion, It remains a significant benefit for homeowners. Individuals can exclude up to $250,000 of capital gains on the sale of their primary residence. While married couples can exclude up to $500,000.

6. Depreciation for real estate investors

Real estate investors continue to benefit from depreciation deductions. They allow the gradual deduction of the cost of the property throughout its useful life. The TCJA introduced 100% bonus depreciation for certain types of property.

They include qualified improvements made to non-residential properties. This provision allows investors to immediately deduct the full cost of these improvements. It also accelerates tax benefits.

7. Qualified business income deduction

Offers a potential 20% deduction on pass-through income for eligible real estate investors. This applies to income from rental properties. That occurs if the activity qualifies as a trade or business under IRS guidelines.

Ensuring your rental activities meet these criteria can result in substantial tax savings.

8. Opportunity zones in real estate

They provide tax incentives for investments in designated low-income areas. This program encourages long-term investments in underdeveloped communities. At the same time, it offers important tax benefits.

The landscape of tax regulations for homeowners and investors is continually changing. So it is essential to stay up to date on these changes. They could affect your financial strategies.

To keep you on the boat, remember that you can count on Connekter. If you would like to explore how we can help you, please leave us a message. We will not take long to contact you.

Extra resources: