To understand the REO listing process in real estate. How to maximize your chances of success with the right tools and resources

My first experience as a real estate investor was with an REO property. I put my first savings into this investment after paying off my student loans. While the experience was incredibly positive and taught me a lot about the real estate market, I wish I had more information and guidance at the time.

Facing a new process, full of unfamiliar terms and unexpected challenges, was a steep learning curve. However, this initial investment became a springboard that propelled my growth in the industry.

I clearly remember the initial visits to the property, the negotiations with the bank, and the necessary renovations to make it sellable. Although the process was complex and sometimes overwhelming, the satisfaction of seeing the project completed and successful was immense.

This experience inspired me to write this article to help those who want to start their journey in the world of REO properties. My goal is to provide the information and resources I wish I had back then, so others can face this challenge with more confidence and preparation.

REO properties are the result of foreclosures that didn’t sell at a public auction, thus becoming owned by the bank or financial institution. These properties are often sold below market value, presenting an excellent opportunity for investors and buyers looking for good deals.

Differences from Other Properties

Unlike traditional property sales, REOs generally require repairs and may be in less favorable conditions. However, the reduced price and the opportunity to negotiate directly with the bank are significant advantages.

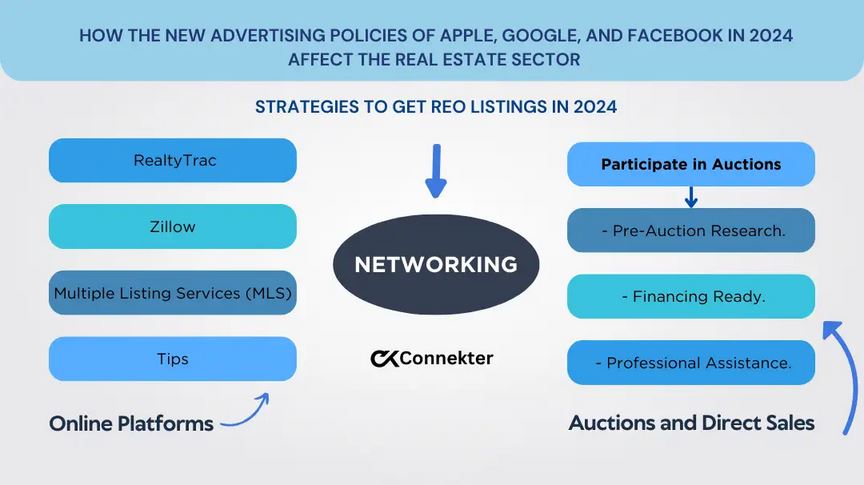

Strategies to Get REO Listings in 2024

Networking

Building strong relationships with banks, financial institutions, and real estate agents specializing in REO is crucial. Attending industry events and participating in real estate associations can open doors to exclusive listings. Joining investor groups and participating in networking events can be especially beneficial for establishing valuable contacts.

Online Lead Generation Platforms

Several online platforms list REO properties. Some of the most notable include:

- RealtyTrac: A robust resource for finding foreclosed and REO properties.

- Zillow: In addition to traditional listings, it also includes REO properties.

- Multiple Listing Services (MLS): Many local MLSs have sections dedicated to REO properties.

Effectively using these platforms involves setting up alerts and filtering results to find the best opportunities. Regularly reviewing these platforms is also useful to stay on top of new properties entering the market.

Auctions and Direct Sales

Participating in auctions and direct sales of REO properties can be an excellent way to acquire these listings. It’s crucial to prepare adequately, know the market, and have financing ready. Here are some tips to excel at auctions:

- Pre-Auction Research: Know the market value and condition of the property.

- Secured Financing: Have your financing ready to act quickly.

- Professional Assistance: Consider the help of a real estate agent experienced in auctions.

Tools and Resources REO Listings

Customer Relationship Management (CRM) Software

Using a CRM specialized in real estate can help manage contacts and follow-ups efficiently. Tools like Salesforce, HubSpot, or Zoho CRM are recommended options. These platforms allow for detailed tracking of communications, tasks, and sales processes.

Courses and Certifications

Specific training in REO properties can enhance your skills and credibility. Certifications like Certified Distressed Property Expert (CDPE) can be very useful. These certifications not only provide technical knowledge but also boost your credibility with potential clients and partners.

Data Analysis

Using data analysis to identify trends and opportunities in the REO market is essential. Tools like PropStream or Reonomy can provide valuable insights. The ability to analyze market data and properties can give you a significant competitive edge, allowing you to make informed and strategic decisions.

Legal Aspects and Considerations REO Listings

Local and State Regulations

Understanding the laws and regulations that affect the purchase of REO properties in your area is vital. Consulting with a real estate attorney can help navigate these requirements. Regulations can vary significantly between regions, so staying well-informed is crucial.

Due Diligence

Conducting thorough due diligence is crucial to avoid legal and financial problems. This includes detailed property inspections, title reviews, and accurate assessments of repair costs. Ensuring there are no hidden liens or major structural issues can save you a lot of headaches and unexpected expenses.

Recommended Real Estate Podcasts

For those looking to dive deeper into REO properties and real estate investment, here are five recommended podcasts:

1. BiggerPockets Real Estate Podcast: A comprehensive podcast covering all aspects of real estate investing, including REO.

2. Real Estate Investing for Cash Flow: Focused on investment strategies and generating cash flow, with episodes on REO properties.

3. The Real Estate Guys Radio Show: Offers advice and strategies for real estate investors, including how to manage and acquire REO properties.

4. Think Realty Radio: Provides insights on the real estate market and investment strategies, including managing REO properties.

5. The Real Wealth Show: Aimed at helping investors create wealth through real estate, with episodes on buying and managing REO properties.

REO property listings offer unique opportunities in the real estate market of 2024. From building networks to using online platforms and participating in auctions, there are various strategies to obtain these listings. Make sure to stay well-informed about local regulations and conduct thorough due diligence. With the right tools and resources, you can maximize your chances of success. This article aims to be a guide to help you start confidently in the world of REO properties.

Extra Resource Links:

- Understanding REO Properties – Investopedia: Real Estate Owned (REO)

- Real Estate Investment Tips – BiggerPockets Real Estate Podcast

- Foreclosure Listings – RealtyTrac

- Property Data and Analytics – PropStream

- Real Estate Courses and Certifications – Certified Distressed Property Expert (CDPE)